Some states calculate interest on refunds from some date other than the due date of the return. Some calculate from 45 or 60 days after the due date or after the overpayment claim was filed. To mirror such a calculation with Instant Interest, you can use the following procedure:

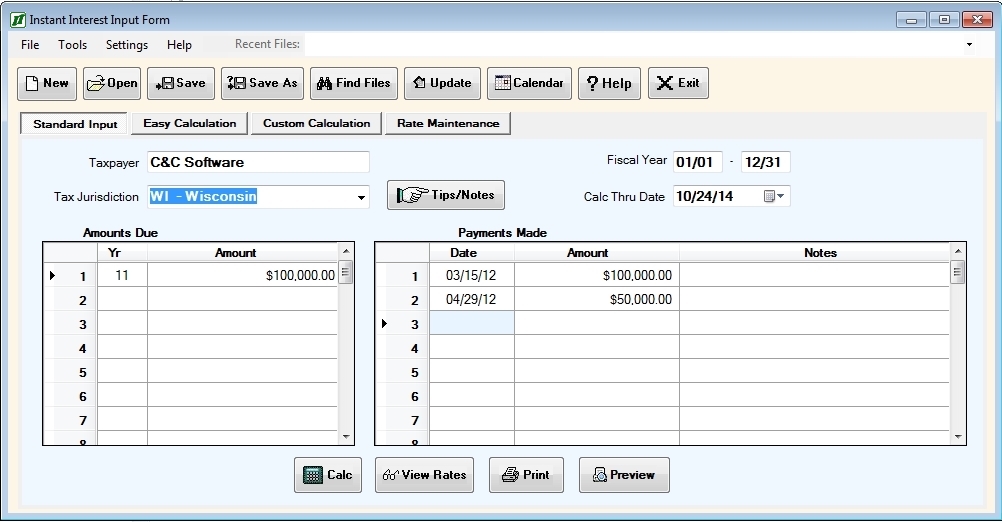

| 1. | Enter the full amount due on the due date of the payment. |

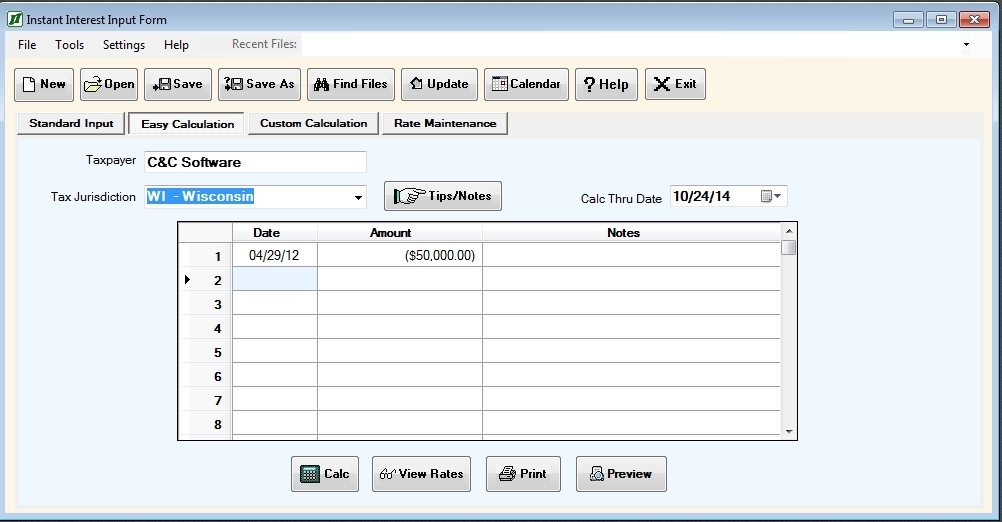

| 2. | Enter the amount of the overpayment on the date from which interest is to be calculated. |

For example, suppose that the taxes due were $100,000 and the payment made was $150,000, but that the state does not begin to calculate interest until 45 days after the due date of the return. You should enter the data as follows:

The same calculation can be set up on the Standard Input tab, but it is a little more complicated:

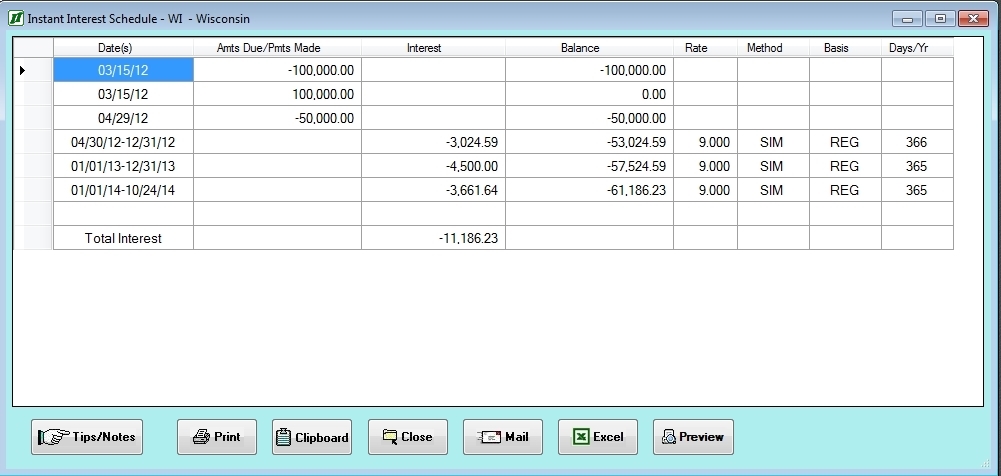

When calculated the resulting schedule will look similar to the following: