The Florida Tax Amnesty program is in effect from July 1, 2003 through October 31, 2003. It only applies to taxes, penalty or interest due on or before June 30, 2003 and adjusts interest due between January 1, 2000 and October 31, 2003. The Tax Amnesty program reduces interest charges as follows:

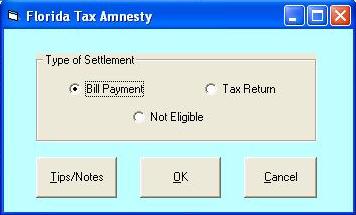

If the Florida Department of Revenue has already discovered and assessed a liability (for example, field audits, billings, jeopardy assessment letters, and warrants), a 25% discount applies. This is the "Bill Payment" option on the Florida Tax Amnesty panel.

A 50% discount applies if the taxpayer has never been contacted by the Department of Revenue but has a liability or if taxpayers have only received communications from the Department of Revenue in the form of letters of inquiry, delinquency notices, or Tax Information Publications (TIPs) or based on self-audits and self-analyses. This is the "Tax Return" option on the Florida Tax Amnesty panel.

To be eligible a taxpayer must:

* Not be currently under criminal investigation regarding a Florida revenue law nor have been convicted of a violation of a Florida revenue law.

* Not have the liability already covered in an existing stipulated payment agreement or settlement agreement.

* Agree to waive all protest rights and rights to refunds related to the liability.

After October 31, 2003, the interest rate on underpayments will be adjusted retroactively as follows:

01/01/00 - 12/31/01 12%

01/01/02 - 06/30/02 11%

07/01/02 - 06/30/03 9%

07/01/03 - 12/31/03 8%

For calculations on underpayments with a Calc Thru Date between 07/01/2003 and 10/31/2003, Instant Interest prompts you for the appropriate tax amnesty discount as follows:

Instant Interest will then adjust the interest rate on the underpayment according to the Tax Amnesty Program. For calculations with the Calc Thru Date falling oafter 10/31/2003, Instant Interest uses the rates as they are going to be adjusted retroactively.

For details on the Florida tax amnesty program, see the Florida Department of Revenue’s page at http://sun6.dms.state.fl.us/dor/amnesty/. For information on the rate changes, see http://sun6.dms.state.fl.us/dor/tips/tip03adm01r.html.